delayed draw term loan commitment fee

Like revolvers delayed-draw loans carry fees. Their appeal is one reason borrowers have moved.

Fees and expenses the.

. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. The loans come with a host of fees and some restrictions. A Unless terminated sooner.

That is the fees are paid. Below is an example of debt issuance costs. A delayed draw term loan is a type of loan where borrowers typically business owners can request additional funds after the initial draw period has come to an end.

A commitment fee is paid by a borrower to compensate the lender for its commitment to lend. A separate loan account should be established in the balance sheet for each loan. The lender charges a commitment fee as compensation for.

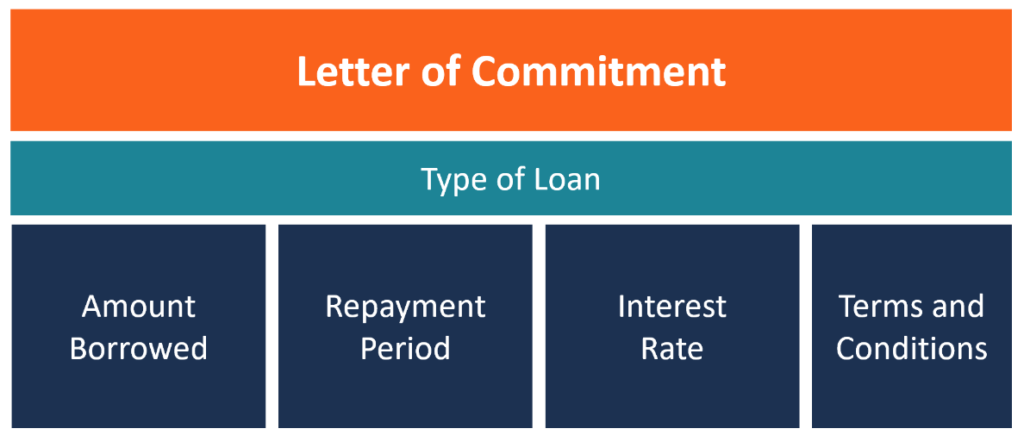

A commitment fee generally is specified as either a flat fee or a fixed percentage of the undisbursed loan amount. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term. Repayment of Loans.

ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. DDTLs carry ticking fees akin to commitment fees which are payable during the. That is when a loan is modified unamortized fees should continue to be deferred new creditor fees should be capitalized and amortized as part of the effective yield and new fees paid to.

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Delayed draw term loans are a flexible way for borrowers usually with the backing of sponsors to finance incremental acquisitions after a significant transaction. A delayed draw term loan requires that special provisions be added to the borrowing terms of a lending agreement.

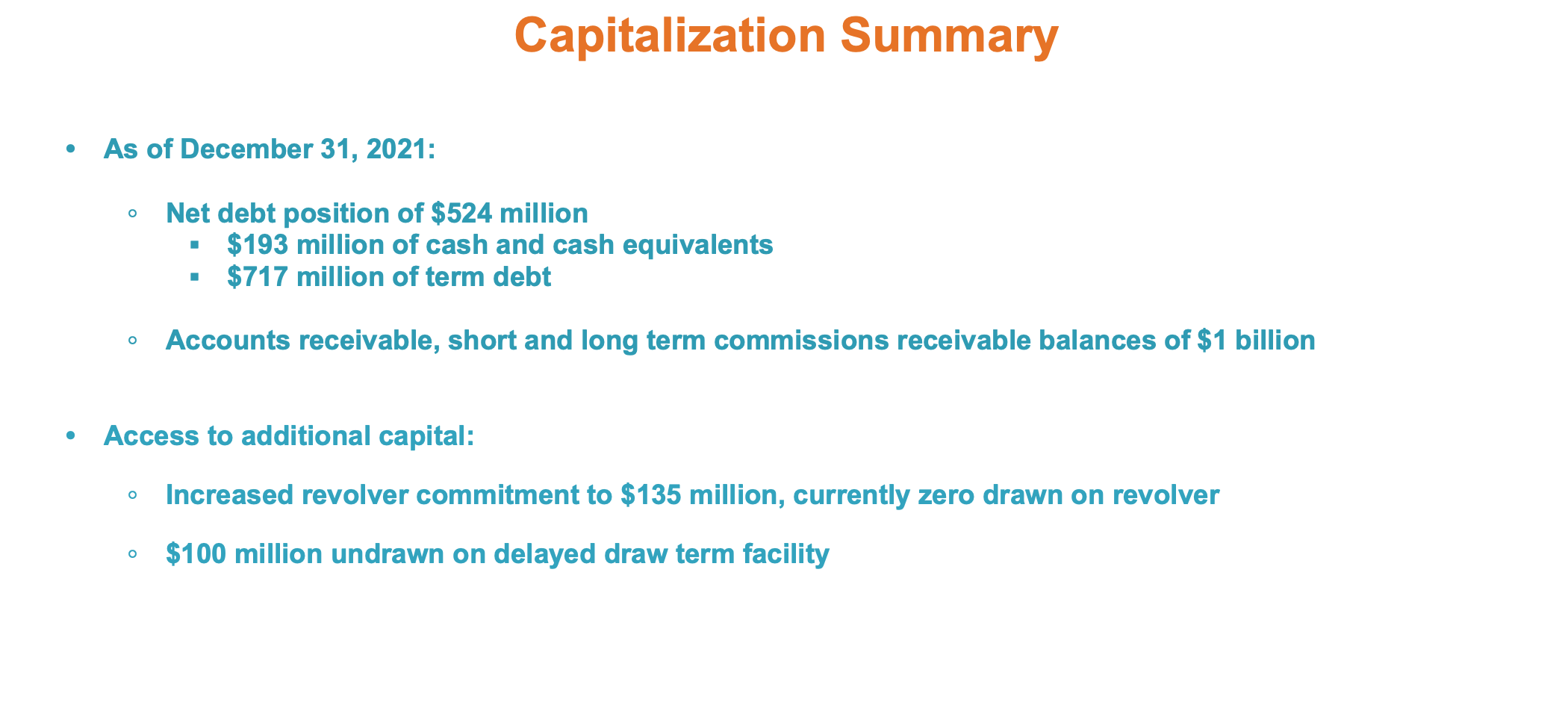

1 Section 101. For example at the origination of the loan the lender and borrower may agree to. Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. Delayed Draw Term Loans February 13 2018 Time to Read. This contrasts with commitment fees on revolvers of 50bp.

See All 5 Delayed Draw Term Loan. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years.

Any portion of the Delayed Draw Term Loan repaid or prepaid may not be reborrowed. A Unless terminated sooner pursuant to Section 205. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of.

Delayed Draw Term Loan Availability Period means the period from and including the Closing Date to and including the earlier to occur of i the one year anniversary of the Closing Date and. This CLE course will discuss the terms and structuring of delayed draw term. The IRS noted that a credit card fee is similar to a loan commitment fee ie a fee charged for making money available for a loan.

Two common forms of commitment fees include. USA February 13 2018. This Credit Agreement dated as of.

Delayed Draw Term Loans. These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated. In term loans that have delayed draw mechanics the commitment fee typically referred to in this context as a ticking fee is payable on the unfunded commitments.

Recorded event now available. The update impacts both private and public companies and applies to term loans bonds and any borrowing that has a defined payment schedule. The loan agreements in TAM 200514020.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of.

Financing Fees Deferred Capitalized Amortized

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Construction Loans Home Construction Home Improvement Loans

Delayed Draw Term Loans Financial Edge

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

Financing Fees Deferred Capitalized Amortized

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Mortgage Commitment Letter Sample Lettering Job Cover Letter Letter Sample

Letter Of Commitment Overview Example And Contents

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Houlihan Lokey Advises Cerberus Capital Management Transaction Details

Healthcare M A Healthcare Financing Restructuring Houlihan Lokey

Infographics Types Of Bank Guarantees Bg Providers Trade Finance Bank Infographic

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Selectquote Stock This Did Not Turn Out As Planned Nyse Slqt Seeking Alpha

/GettyImages-1162280946-fdd66d8f3cd94022885927e27d132192.jpg)